In the competitive world of Multifamily real estate, maximizing profits and minimizing tax liabilities are essential for sustainable growth. One powerful tool that property owners and investors can use is bonus depreciation. This tax provision allows multifamily businesses to accelerate depreciation deductions on qualifying assets, providing significant financial benefits. This blog post will explore how bonus depreciation can help you grow your multifamily business and enhance your bottom line.

Understanding Bonus Depreciation

Depreciation is a method used to recover the cost of an asset over its useful life. The conventional depreciation rules the Internal Revenue Service (IRS) set requires spreading the deduction over several years. However, bonus depreciation enables businesses to take an immense belief in the year an asset is placed in service.

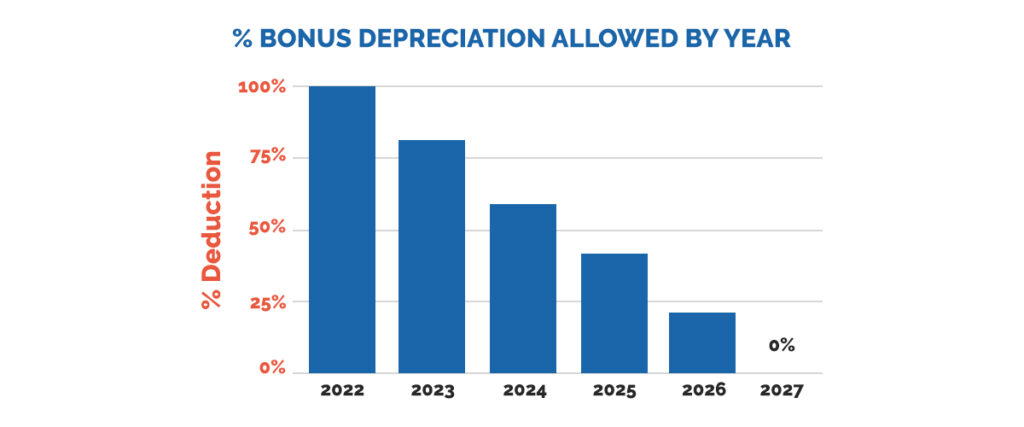

The Tax Cuts and Jobs Act (TCJA) passed in 2017 expanded bonus depreciation to provide a 100% deduction for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. This provision was enacted to encourage investment in the economy and stimulate growth.

Benefits of Bonus Depreciation for Multifamily Businesses

- Increased Cash Flow: By accelerating depreciation deductions, bonus depreciation allows multifamily businesses to reduce their taxable income and improve their cash flow. This additional cash can be reinvested into property improvements, acquisitions, or other growth strategies, providing a competitive advantage in the market.

- Faster Return-on-Investment (ROI): Multifamily properties typically involve significant upfront investments. Bonus depreciation enables property owners to recover a more substantial portion of their investment sooner, reducing the time it takes to achieve a positive ROI. This can be particularly advantageous for new multifamily developments or properties undergoing substantial renovations.

- Improved Property Value: Upgrading and enhancing the amenities and infrastructure of a multifamily property is crucial for attracting and retaining tenants. By leveraging bonus depreciation, property owners can offset some of the costs of these improvements, making them more financially feasible. The ability to offer upgraded features can significantly increase the property’s market value, leading to higher rental income and improved overall returns.

- Competitive Edge in Acquisitions: Multifamily businesses looking to expand their portfolio through acquisitions can gain a competitive edge by utilizing bonus depreciation. The ability to immediately deduct a substantial portion of the purchase price of qualifying assets reduces the taxable income associated with the new property. This not only improves the financial viability of the acquisition but also provides a potential tax shield against future income from the property.

- Attractive to Investors: Bonus depreciation can make multifamily businesses more attractive to potential investors. Accelerating depreciation deductions can enhance the return on investment for individuals or entities considering investing in multifamily properties. This can help attract more capital, fueling the growth of the business and enabling further expansion.

- Tax Planning Flexibility: Bonus depreciation provides multifamily businesses with greater flexibility in tax planning. Property owners can strategically time their deductions based on their specific financial goals and circumstances. This flexibility can be precious in managing tax liabilities and optimizing cash flow during different stages of property ownership or when facing unique financial situations.

Read More – Why Multifamily Investing Should Be Part of Your Financial Strategy

Considerations and Limitations

While bonus depreciation offers numerous advantages, it is essential to understand its limitations and considerations. Here are a few key points to keep in mind:

- Qualified Property: Bonus depreciation applies to an eligible property, which includes assets with a recovery period of 20 years or less. Land, used property, and assets ineligible for depreciation, such as inventory, do not qualify.

- Time Limitations: Bonus depreciation is scheduled to phase out gradually after 2023. The deduction will be reduced to 80% for property placed in service in 2023, 60% in 2024, 40% in 2025, and 20% in 2026. After 2026, bonus depreciation will only be available if legislation extends or modifies the provision.

- Alternative Depreciation Systems: Some multifamily businesses, such as those involved in low-income housing or historic preservation, may be subject to alternative depreciation systems with specific rules and limitations. It is essential to consult with a tax professional to understand the applicability of bonus depreciation in such cases.

Conclusion

Bonus depreciation offers multifamily businesses a powerful tool to accelerate deductions and increase cash flow, providing a competitive advantage and fueling growth. By taking advantage of this tax provision, property owners and investors can enjoy increased cash flow, faster ROI, improved property value, and a competitive edge in acquisitions. Additionally, bonus depreciation can attract investors and provide tax planning flexibility. However, it is crucial to understand the qualifications, limitations, and timing considerations associated with bonus depreciation. Consulting with a tax professional experienced in real estate can help optimize the benefits and navigate the complexities of this tax provision, ultimately helping you grow your multifamily business and achieve long-term success.

What is NewLife Capital Group?

NewLife Capital Group, LLC is a privately held investment firm that focuses on acquiring and managing high-performing value-add multifamily properties. In addition, we concentrate on repositioning multifamily assets in emerging markets that yield solid returns for our investors. Strategically investing in real estate helps our investors achieve a new life of financial freedom by generating passive income.

Ready to invest? Schedule a call with us.

We bring together knowledgeable and astute investors who, under our direction, can use the group’s superior financial strength to invest in carefully selected, high-performing deals.

14 Responses

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Lois Sasson This was beautiful Admin. Thank you for your reflections.

of course like your website but you have to check the spelling on several of your posts A number of them are rife with spelling issues and I in finding it very troublesome to inform the reality on the other hand I will certainly come back again

Ezippi I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

At BWER Company, we prioritize quality and precision, delivering high-performance weighbridge systems to meet the diverse needs of Iraq’s industries.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Noodlemagazine Nice post. I learn something totally new and challenging on websites

Technology us For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.