March 2023 United States bank failures

In March 2023, two large US banks that had significant exposure to the technology sector or to cryptocurrency failed, and another bank entered liquidation due to financial distress. This led to large interbank flows of funds to strengthen bank balance sheets, and many analysts reported on a more general banking crisis in the US.

Some banks had invested their reserves in US Treasury securities, which paid low-interest rates. When the Federal Reserve began raising rates in 2022, bond prices declined, reducing the market value of bank capital reserves. This led some banks to sell bonds at significant losses, as yields on new bonds were much higher.

Eleven of the largest US banks provided up to $30 billion to support the San Francisco-based First Republic regional bank, which was teetering on the brink of collapse. Additionally, the Federal Reserve’s discount window liquidity facility had experienced approximately $150 billion in borrowing from various banks by March 16.

The first bank to fail was Silvergate Bank, which focused on cryptocurrency. It announced it would wind down on March 8 due to losses in its loan portfolio. Two days later, Silicon Valley Bank collapsed and was seized by regulators following a bank run, which occurred after it announced an attempt to raise capital. Signature Bank, which frequently did business with cryptocurrency firms, was closed by regulators two days later on March 12 due to systemic risks.

The collapses of Silicon Valley Bank and Signature Bank were the second and third largest bank failures in the history of the United States, smaller only than the collapse of Washington Mutual during the global financial crisis in 2008.

How is Multifamily Connected to a Bank’s Collapse?

The collapse of a bank is a complex and multifaceted event that can be influenced by a range of factors. One factor that has been identified as playing a role in some bank collapses is the bank’s involvement in the multifamily real estate market.

Multifamily real estate refers to residential properties that contain multiple units, such as apartment buildings or condominium complexes. These types of properties are often attractive investments for banks, as they can generate steady streams of rental income and offer the potential for long-term appreciation in value.

However, banks can run into trouble when they become too heavily invested in the multifamily market. This can happen when banks extend large amounts of credit to developers or investors who are building or acquiring multifamily properties. If the multifamily market experiences a downturn, or if the borrowers are unable to repay their loans, the bank may find itself with a large amount of non-performing loans on its books.

This can be especially problematic for smaller banks that do not have the same level of resources as larger institutions. If a bank’s balance sheet becomes too heavily weighted towards non-performing loans, it may struggle to meet its obligations to depositors and creditors, and may ultimately be forced to close its doors.

In some cases, banks have also been implicated in fraudulent activities related to multifamily real estate. For example, a bank may collude with a developer to inflate the value of a property in order to secure a larger loan or may provide financing for a project that it knows is unlikely to be successful. These types of activities can lead to losses for the bank and its investors, and can ultimately contribute to a bank’s collapse.

It’s worth noting that not all bank collapses are linked to multifamily real estate. Banks can fail for a variety of reasons, including poor management, inadequate risk controls, or external economic factors. However, given the potential risks associated with multifamily lending, it’s an area that bank regulators and investors are likely to keep a close eye on in the future.

Country, Economics, and Multifamily

According to an article in GlobeSt, commercial real estate companies, and venture capital groups are considering various factors in the aftermath of the failure of Silicon Valley Bank and Signature Bank. These factors include the recent decrease in home mortgage rates, the possibility of the Federal Reserve pausing or decreasing interest rates at its March 22 meeting, and the need to obtain new letters of credit.

The housing market and multifamily housing

The collapse of a bank can have significant impacts on the housing market and multifamily housing sector. For example, if a bank provided financing for a significant number of mortgages or multifamily properties, its failure could lead to disruptions in the availability of credit for buyers and investors. This could lead to a slowdown in the housing market and a decrease in demand for multifamily properties, potentially leading to lower prices. Additionally, if the bank’s failure was caused by broader economic issues, such as a recession or interest rate hikes, this could further exacerbate these impacts. Overall, the collapse of a bank can have ripple effects throughout the real estate industry, highlighting the interconnectedness of various sectors and the importance of monitoring economic and financial risks.

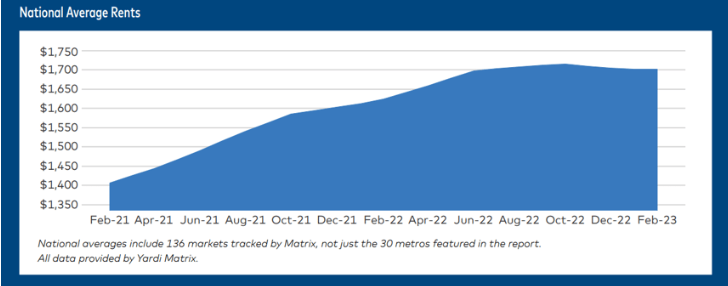

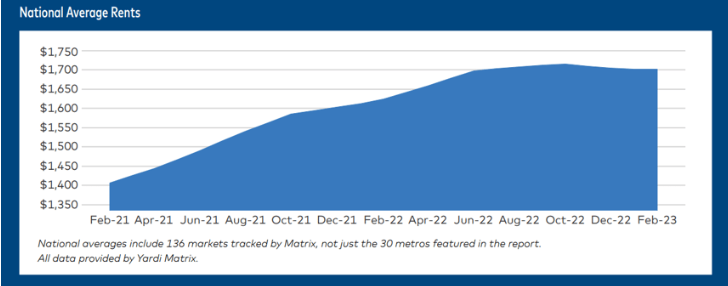

According to Yardi Matrix, the growth of multifamily rents has stalled, with no positive or negative change in national monthly rent growth during the end of the winter season. However, some Midwestern markets are still experiencing positive growth.

Markets and Reports for Multifamily

Markets and Reports for Multifamily

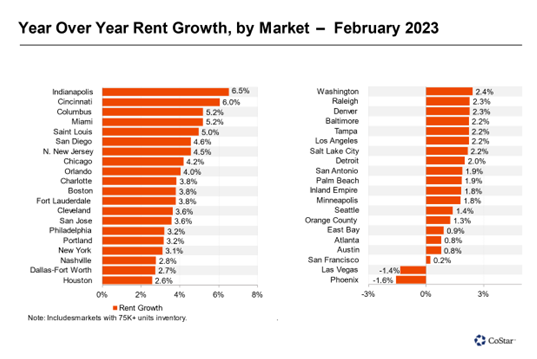

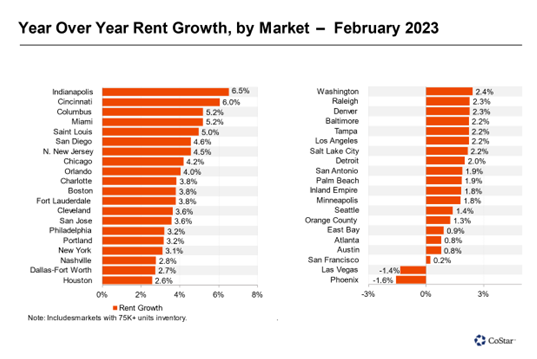

CoStar reports that Indianapolis has once again taken the lead for the third consecutive month in terms of having the highest market rent growth. Several other Midwest markets also rank among the top 10 for rent growth, likely due to fewer issues with new supply additions in these areas.

Business Real Estate and the Whole Economy

CoStar reports that Indianapolis has once again taken the lead for the third consecutive month in terms of having the highest market rent growth. Several other Midwest markets also rank among the top 10 for rent growth, likely due to fewer issues with new supply additions in these areas.

Business Real Estate and the Whole Economy

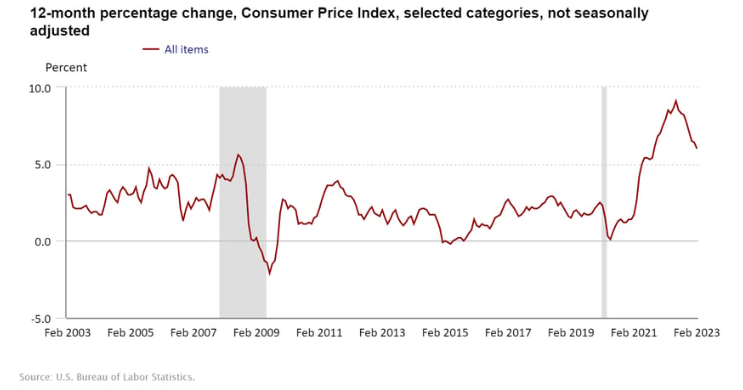

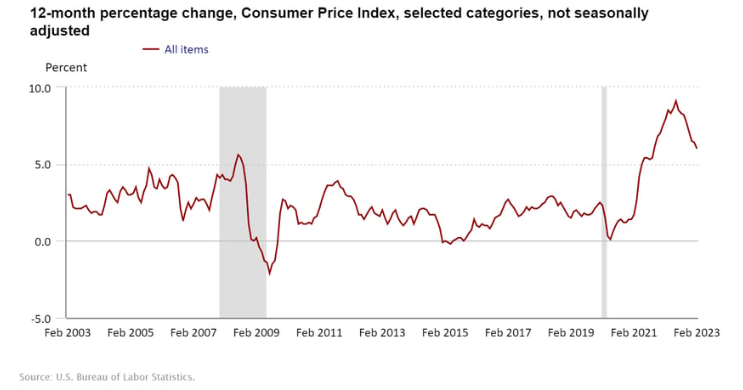

According to the Bureau of Labor Statistics, the increase in the index for shelter had the greatest impact on the overall increase in monthly prices, accounting for more than 70 percent of the increase. The indexes for food, recreation, and household furnishings and operations also had some contribution to the increase.

News and Updates About Other Real Estate

According to the Bureau of Labor Statistics, the increase in the index for shelter had the greatest impact on the overall increase in monthly prices, accounting for more than 70 percent of the increase. The indexes for food, recreation, and household furnishings and operations also had some contribution to the increase.

News and Updates About Other Real Estate

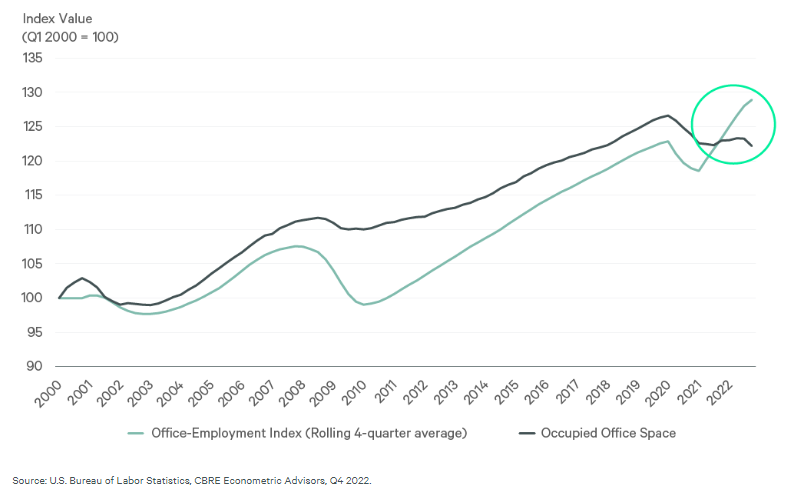

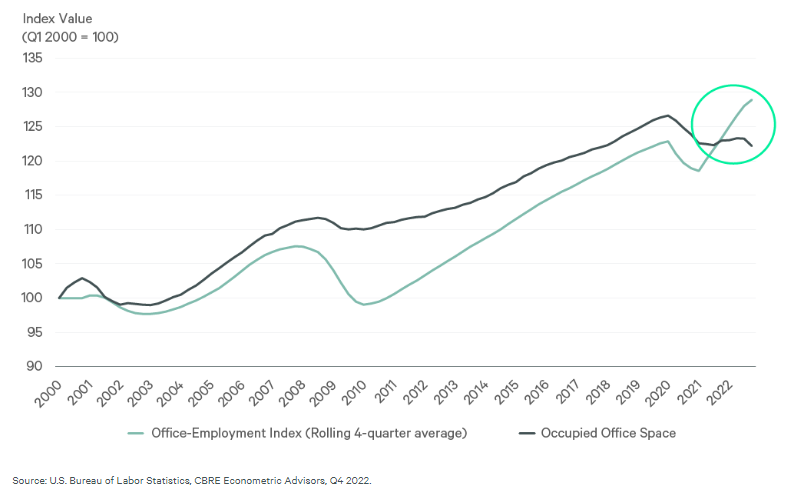

CBRE reports that while office-using employment in the U.S. has been consistently rising for eight of the past ten quarters and is currently 5.4% higher than pre-pandemic levels, the amount of occupied office space has remained largely unchanged.

CBRE reports that while office-using employment in the U.S. has been consistently rising for eight of the past ten quarters and is currently 5.4% higher than pre-pandemic levels, the amount of occupied office space has remained largely unchanged.

Markets and Reports for Multifamily

Markets and Reports for Multifamily

CoStar reports that Indianapolis has once again taken the lead for the third consecutive month in terms of having the highest market rent growth. Several other Midwest markets also rank among the top 10 for rent growth, likely due to fewer issues with new supply additions in these areas.

Business Real Estate and the Whole Economy

CoStar reports that Indianapolis has once again taken the lead for the third consecutive month in terms of having the highest market rent growth. Several other Midwest markets also rank among the top 10 for rent growth, likely due to fewer issues with new supply additions in these areas.

Business Real Estate and the Whole Economy

According to the Bureau of Labor Statistics, the increase in the index for shelter had the greatest impact on the overall increase in monthly prices, accounting for more than 70 percent of the increase. The indexes for food, recreation, and household furnishings and operations also had some contribution to the increase.

News and Updates About Other Real Estate

According to the Bureau of Labor Statistics, the increase in the index for shelter had the greatest impact on the overall increase in monthly prices, accounting for more than 70 percent of the increase. The indexes for food, recreation, and household furnishings and operations also had some contribution to the increase.

News and Updates About Other Real Estate

CBRE reports that while office-using employment in the U.S. has been consistently rising for eight of the past ten quarters and is currently 5.4% higher than pre-pandemic levels, the amount of occupied office space has remained largely unchanged.

CBRE reports that while office-using employment in the U.S. has been consistently rising for eight of the past ten quarters and is currently 5.4% higher than pre-pandemic levels, the amount of occupied office space has remained largely unchanged.